Financial Effectiveness is Key

HOAs are most commonly nonprofit corporations organized under state law. Most HOAs are created with the purpose of not maximizing profit, but to operate for the benefit of the owners of the HOA. In most scenarios, this means charging owners assessments (revenue for the HOA) and paying expenses to run the HOA with an ideal plan of having zero profit or loss at year’s end. While that is ideal, it doesn’t always happen. As with any business, issues can arise and impact the financials of the HOA.

The Board is elected to run the HOA business and, in doing so, they may hire vendors to help. Thus, the financials of the HOA are one of the pillars of effective HOA operations. Section Five discusses how revenue comes to the HOA (regular or special assessments to owners largely), types of expenses (operating and reserve), financial tracking systems, and financial reports best for your HOA.

With the groundwork discussed above, most times HOAs are left to address aspects of financials that don’t go as planned or are not within an annual budget of revenue and expenses. The below discusses potential areas HOAs may encounter and Best Practices to handle these items.

Owner is Not Paying Assessments

Strong policies are vital for HOA success. HOAs are oftentimes forced to take actions that are not desirable but needed to ensure all owners are fairly and consistently dealt with.

General guidelines for dealing with owners who are not paying assessments including a policy of those assessments that are delinquent for more than two months, and to begin lien proceedings when appropriate:

-

- Owners will receive a courtesy notice of delinquent or past due account, which will spell out the consequences for missing the payments that are owed.

- If any installment of an assessment, whether annual or special, becomes more than sixty (60) days past due, then the Board may, upon ten (10) days’ written notice to the Owner, declare the entire amount of the assessment immediately due and payable in full.

- If the above fails, engage legal counsel to pursue further actions. All fees and expenses relating to the collection of an account will be assessed to the delinquent owner.

Cautionary note: Once legal counsel is engaged, the HOA should not have contact with the delinquent owner, but let legal counsel handle the matter.

|

Case Example: Owner Jane is late with her assessments–when she lost her job 3 months ago, she stopped paying her dues. Parkview HOA has attempted to work out a payment plan with Jane and offered to defer the charges until she lands a new job. Jane has refused to work with the HOA. Out of options after working through the written collection policy, Parkview HOA retains Lawyer John to collect Jane’s past due amounts and costs. After receiving John’s letter, Jane immediately calls Joe, a Parkview HOA Board member. Joe, thinking he is helping and sympathizing with Jane, tells Jane she is okay to not pay until she finds a job. John learns of this arrangement and his work is for naught as the HOA has made an offer to an owner which John would not have recommended and is inconsistent with his planned actions. Now, the HOA is out of pocket on costs to Lawyer John, while still waiting on Jane to pay her assessments. |

Vendor Disputes on Payments

Documentation and adherence to the contract are fundamental. Disputes on vendor payments usually involve issues with a service or product, which may also include a violation of the contract. This can become a time-consuming and adversarial situation where a vendor believes the work is completed per the contract and the HOA disagrees, or vice versa. The common consideration to use to resolve this is the HOA withholding payment to the vendor. This can also lead to damaged relations and costs to correct work done.

|

Case example: Vendor Jerry builds a retaining wall at Alter Village HOA. Jerry believes the project is completed and wants the HOA to pay him the balance owed which is $3,000. Alter Village HOA disagrees and sees that the drainage sources are missing from the retaining wall, which over time can undermine the wall’s foundation and cause it to fall over. Jerry states that drainage is not needed and not part of the contract. Vendor Andy reviews the work and agrees with Alter Village HOA. The cost to now install these is $2,500. Alter Village HOA reviews the contract and it does state drainage source will be included. Alter Village HOA notifies Vendor Jerry who denies this and demands payment of $3,000 from HOA. |

Alter Village is faced with a challenging situation, but has options:

-

- Retain Vendor Andy to complete the work at $2,500 and pay $500 to Vendor Jerry with notice that this settles all items with Alter Village HOA. This could result in Jerry responding with a demand for $2,500 which ultimately will need to be resolved amicably or most likely in court or mediation.

- Demand in writing that Vendor Jerry complete drainage sources as part of the contract before $3,000 is paid by Alter Village HOA. This could result in poor work quality if Vendor Jerry is not pleased and does not commit entirely to the project as he is upset at this process.

Best practice: Hire Vendor Andy after providing notice to Vendor Jerry in writing with the option to correct the issue subject to Alter Village HOA’s review and agreement. This is the best of the options as it will still hold a warranty with one vendor while not creating a dual vendor situation. Down the road, this could result in either vendor blaming the other for work issues.

Inadequate Reserves

No rainy day funds. In HOAs, this translates to low or inadequate reserve funds to pay for projects that arise. If the HOA doesn’t have enough money, it may have to issue a special assessment to owners to replenish the reserve funds.

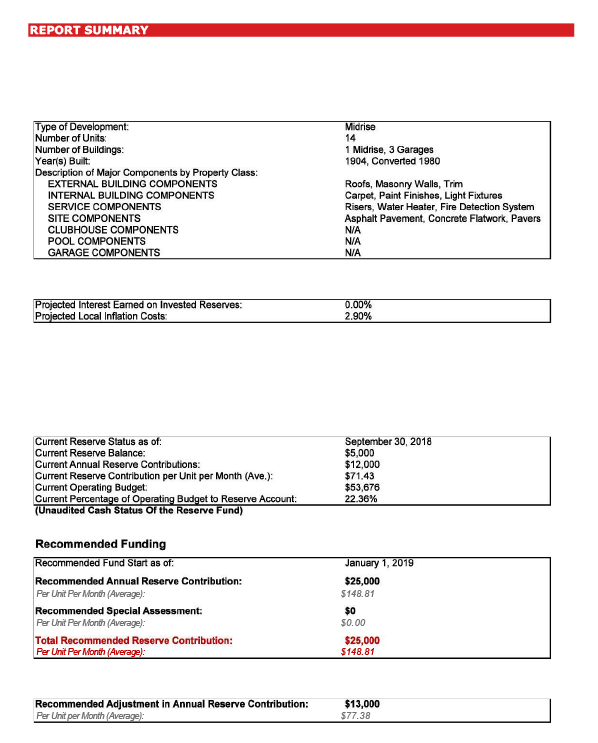

Cautionary note: Many states mandate that HOAs maintain an adequate reserve for the HOA. Practically, the determination of the amount in the reserve fund account can vary by State. It is advisable and often required to complete a professional reserve study for your HOA to ensure a roadmap is in place in this area–an example of which can be found in Exhibit 6.1. Reserve studies are typically completed by professional companies in architecture, engineering, and forecasting HOA costs related to property items.

Best practice: the HOA commits to setting aside funds each month into the reserve account. This is basic budgeting and provides a good basis for owners selling and buying. This is important, particularly with buyers using financing that requires various budgeting factors of which one commonly is contributions to a reserve.

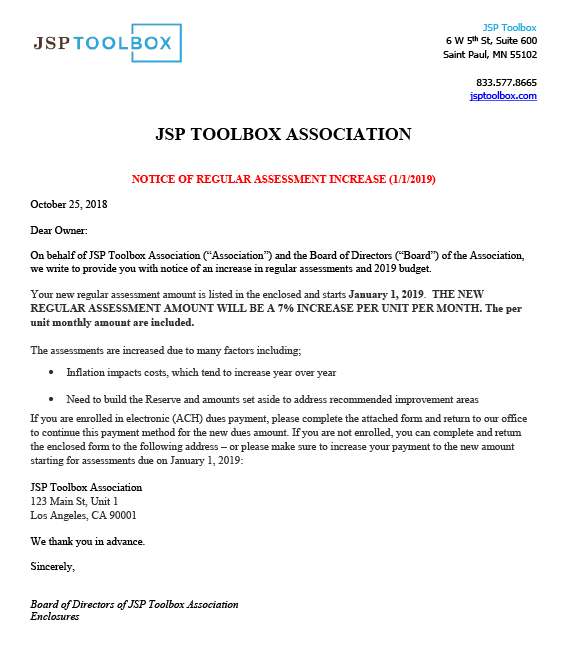

Increasing Regular Assessments

When informing owners about raising dues, be direct and concise. Owners have a vested interest in the HOA and must understand the need to raise a regular assessment to stay current with other rising costs and perhaps to rebuild reserves. Not raising regular assessments regularly can be worse than raising them as the pressure on the HOA finances only becomes greater as costs tend to increase over time. If regular assessments do not correspondingly increase, the outcome can be a reduction of service or quality to HOA owners of items consumed in operating the HOA. For an example of communication relaying an increase of regular assessments, view Exhibit 6.2.

Best practice: Be direct in the communication to owners on raising regular assessments. Owners tend to be reasonable people who may not like to pay higher dues, but also prefer having the services they are accustomed to as part of the HOA. In communications, less is more but make sure to include a budget and breakdown for all owners. This makes the communication simple and uniform for all owners, rather than drafting a personal message for each owner. This saves the HOA time and costs.

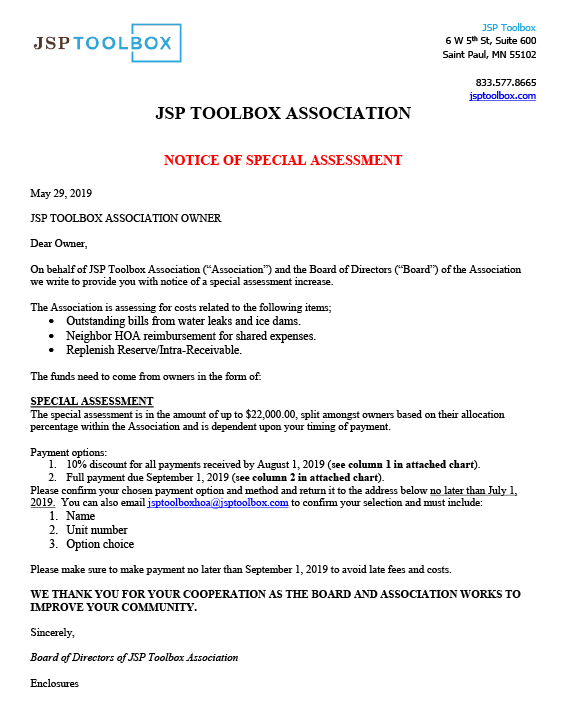

Enacting a Special Assessment with Payment Options

Special assessments should be made for a specific purpose and communicated to owners. There should be a valid and purposeful reason to enact a special assessment, such as:

-

-

- Funding for project work to improve the HOA

- Raising capital to replenish reserve funds

- To pay unforeseen or unexpected cost item

- Set aside funds related to non-reoccurring or capital-related project items

-

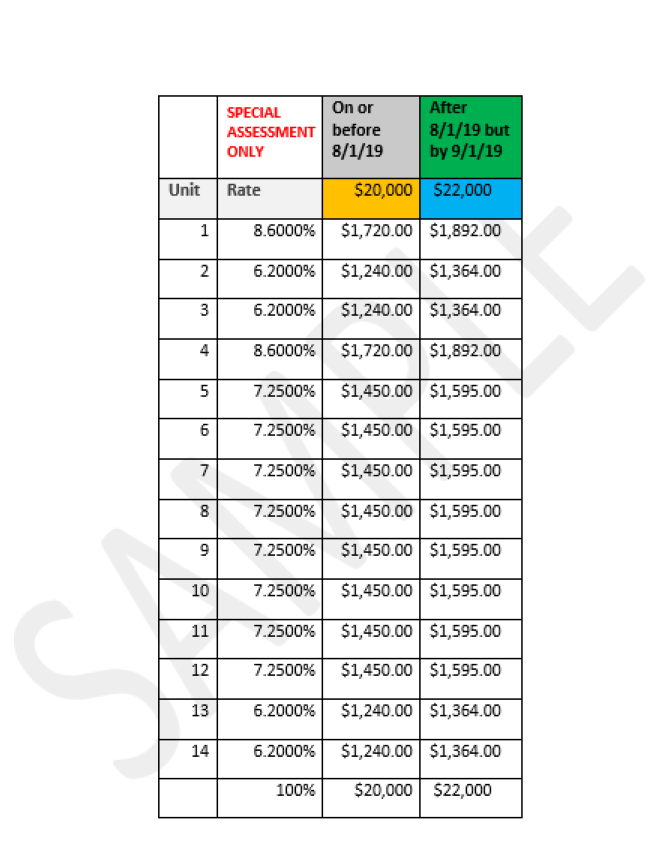

Providing owners payment options for special assessments oftentimes is more amenable than a one lump sum payment. This also can entice owners to pay timely and avoid receivables when the HOA needs funds to pay for the project items. Exhibit 6.3 showcases a template for a special assessment letter with payment options. You can see in Exhibit 6.4 one way of presenting information to homeowners on how the special assessment can be paid with the presented options.

Cautionary note: While sometimes difficult to foresee, the HOA should not utilize frequent or several special assessments during consecutive fiscal years to avoid the perception of inadequate oversight of HOA funding. This is always caveated upon actual needs by and events arising within the HOA.

Best practice: Use special assessments as a market factor when regular assessments of HOAs are at levels that can impact buying or selling options to owners. HOA regular assessment (dues) that are higher due to HOAs deciding to raise these in lieu of special assessments can have impacts in the selling and buying marketplace. Regular assessments tend to not be reduced and are viewed as more permanent in nature than special assessments, which many views rightfully as being aligned with a specific project or purpose and thus can have fewer impacts on the marketplace perception.

When it comes to financials and HOAs, there tend to be three common items that cause issues:

All owners are members of the HOA club. To operate effectively and as planned, all owners need to pay their assessments for the HOA to meet the planned expenses to operate the HOA. In most HOAs, this is the beginning and end of the issues around financials. When HOAs do not collect the revenue budgeted for in the annual budget, that means there is either a loss from operations or the HOA must cut planned spending to meet the planned budgeted items.

Perhaps larger, when an HOA does not have adequate reserves, this increases the likelihood for a needed special assessment–or capital raise–from owners. This situation typically results from the scenario of regular assessments being too low or owners not paying timely, or perhaps more severe, many deferred maintenance items are now coming due. Deferred maintenance refers commonly to items that are needed to be repaired but have not been done so by an HOA, and thus deferred.

Not addressing these items in a timely fashion has an increasingly negative impact, as costs tend to rise as time goes on. Any unplanned maintenance item too can impact the HOA and factor into low reserve funds.

To combat these items and place the HOA on firm, financial ground, effective policies, planning, and processes as described above are vital. HOAs should use the information available, rely on experts when needed, and be candid but clear to owners on assessment needs.